- The price of RPL is trading at $41.57.

- The RPL price increased by +0.44% in the last 24 hours.

- The RPL year-to-date return is +108.14%.

Monthly Trend Analyzation

This month the trend was bearish as the price was up by 12.73%. We can say that RPL is underperforming by trend and price information history.

All-Time History Analyzation

The RPL coin’s value surged by more than 60% in all-time history, giving good returns to the investors’ money.

In 1-D Timeframe

Trendline Analyzation

As per the trendline, it respecting multiple support and rejection very well, taking exactly from the drawn trendline on the chart. Recently, it formed a commonly seen pattern which is a symmetrical triangle, and a couple of days earlier it gave a breakdown from the lower trendline on which it was taking support but eventually, the support was destroyed by the bears and we observed good momentum downward. Therefore, at this point, we can observe that it took support exactly from our support zone very effectively. If the bears destroy this support zone, the price can climb down even further soon. Therefore, It can reach $37 soon which is the nearest major resistance.

Supertrend

With the help of just two parameters: period and multiplier, this indicator works well. At period value 20 and multiplier value 2, it shows the continuous trend if it’s bullish or bearish. As shown in the chart, it’s bearish.

MACD

As we can see in the chart, the blue line or MACD line has crossed the signal line from above while making a bearish crossover. This indicates a bearish trend signal. On the day of writing, the MACD line is already on the negative side and the signal line is also on the negative side of the MACD indicator. This highlights that the trend may continue downward.

EMA

The price is going up on the 1D chart. It is below the 20, 50 & 100 EMA (exponential moving average), which is resisting the trend and pushing it downwards. The sellers are stronger than the buyers which shows that the price is unable to reach above resistance levels as resistance is high by the bears. To change the direction, the price has to go up and stay above the 20, 50 & 100 EMA’s. Also, the price stayed above 200 EMA as the observed price is taking support on 200 EMA if it fails then it’ll go downwards from 200 EMA as well. Hence, it can be inferred that the price might fall soon if support is destroyed.

Bollinger Band

In the Bollinger Band indicator, the RPL coin price is trading at the lower band. After taking rejection from the 20-day Simple Moving Average (SMA) of the Bollinger Bands, it is indicating a more downward move.

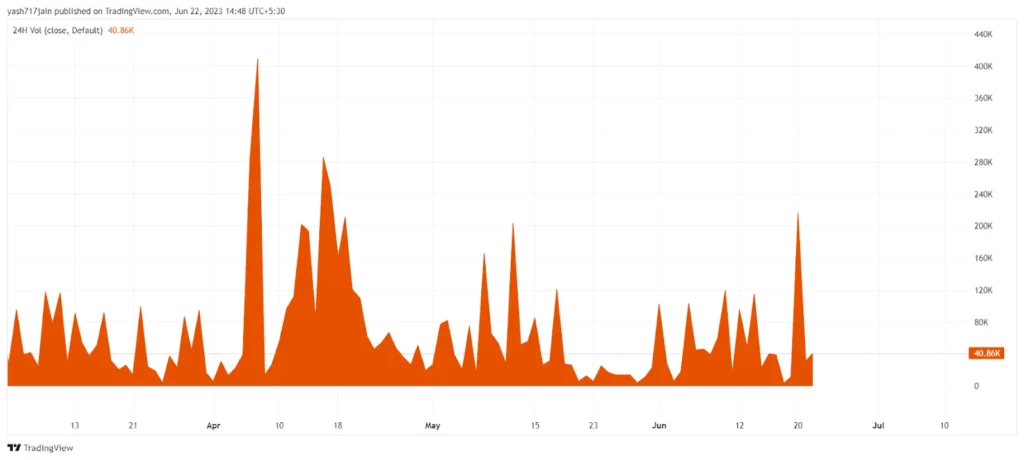

Volume Analyzation

The amount of RPL traded in a day is $10712035. It rose by 83.57% since the last day. The trading activity is comparatively good in RPL which is the reason the price is taking support now from 200 days of EMA. Therefore, it can push the price up if considerable volume comes in the future, if volume fails the coin, then we can see its upcoming fall. Now, it can be inferred that the price can fall if volume breaks by the slightest amount.

Conclusion

The RocketPool (RPL) coin price as per the price action is bearish. Currently, the technical parameters indicate bearish pressure in the upcoming trading days. Presently, the sentiments of investors and traders are bearish.

Technical Levels:

- The Nearest Support level is $37.85.

- The Nearest Resistance Level is $53.84.

Disclaimer

In this article, the views and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.