- The crypto trading volume has nosedived the lowest in the last 4 years. At the same time, Binance is seeing a decline in its trading volume too due to various reasons.

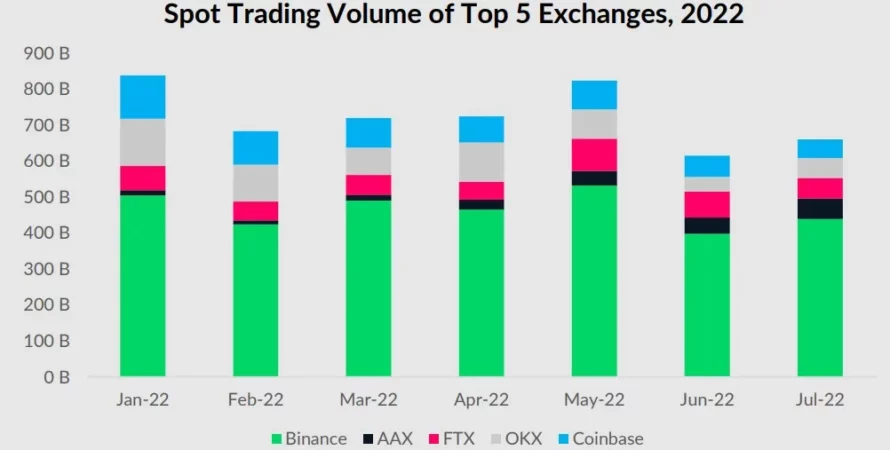

The crypto markets are not doing well if you look at the recent trends. Since 2019, the decentralized assets are witnessing their lowest prices. While spot trading plummeted 21.8% last month with an overall value of $494 billion, combined trading volume has also fallen to a great extent. The spot and derivatives markets saw a 15.7%fall on centralized exchanges. In figures, it is $2.41 trillion to be precise.

Effect of a sustained downtrend

As the exchange review report released by CCData, the declining price movement of Bitcoin and Ethereum for a prolonged period has largely triggered it. With the registered daily volume coming down to $24 billion, the annual volatility of digital assets has crashed to an unprecedented level. As a result, it has caused some panic among the community. However, many are hopeful that this downtrend will be over soon.

The report has also mentioned that the decline in combined trading volume has been highlighted by the crypto exchange giant Binance too. According to it, the spot trading volume slumped to $212 billion with a 26% fall since November 2020. The derivates, on the other hand, derivatives plunged to $1.10 trillion with a 16.5% since December 2022.

Binance’s own struggles

The descent in the trading volumes across the board has taken a toll on Binance’s market share too. Although, in this case, there could be a few more reasons too to account for. The leading exchange has been under regulatory scrutiny and it recently faced some legal troubles too. Another bummer was the suspension of zero-fee trading for USDT pairs as their decline happened right after this announcement.

From a global perspective though, the derivatives trading volume has slid down by 15.7%. The market value has touched the lowest since December 2022 which is now $1.95. Interestingly, the derivatives trading on centralized exchanges leapfrogged by 79.8% reaching a never-before-seen level.

For Binance though, the major hit was the SEC’s allegations after which, the platform saw the withdrawal of $790 million. Recently, the US Security and Exchange Commission has filed a lawsuit against Binance and Coinbase for offering “unregistered securities”.

The charges even involve the CEO and blame him for amalgamating Binance’s own funds with that of its investors. Moreover, the charges talk about Binance violating its own norms to charm its investors. As per the allegations, Binance allowed its institutional investors to access international exchange when it was supposed to route them to the US-only platform.

Conclusion

While Binance has so many internal reasons to blame for its decrease in trading volumes, the global scale pretty much depends on major coins’ movements. So we’ll have to see when the market trend takes an opposite turn and make the investors happy.