- The price of ETH is trading at $1888.90.

- The ETH price decreased by 0.63% in the last 24 hours.

- The ETH year-to-date return is +57.76%.

Weekly Trend Analyzation

This week the trend was bullish as the price was up by 9.69%. By trend and price information history, we can say that ETH is performing well.

All-Time History Analyzation

The coin’s value surged by more than 12000% in all-time history, giving good returns to the investors’ money.

Chart Analyzation In 1-D Timeframe

Trendline Analyzation

As per the trendline, it is respecting multiple support and resistances very well, taking from the drawn trendline on the chart and between the zones. It was bearish before from the point where it was rejected from the supply zone. Recently, it took support from the demand zone. So, as price action speaks, it already took support on the zone and it is trying to sustain and slowly approach the supply zone. It can reach $2015.9 soon which is the nearest major resistance.

MACD

The MACD line crossing above zero is a bullish signal indicating upward momentum and a likely price increase. This is because the MACD line is a momentum indicator that is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. When the MACD line crosses above the zero line, it is an indication that the short-term EMA is higher than the long-term EMA, and it is seen as a bullish signal. This suggests that the current momentum is positive and that the price may increase.

EMA

The price is going up on the 1D chart. It is above the 20, 50, 100 & 200 EMA (exponential moving average), which is resisting the trend and pushing it upwards. The buyers are stronger than the sellers which shows that the price is capable to reach above resistance levels as support is high by the bulls. To change the direction, the price has to go below and sustain below the 20, 50, 100 & 200 EMA. Hence, it can be inferred that the price might rise soon.

RSI

When rsi moves above 70, it indicates that prices may have risen too far too fast and should soon start to drop; when it moves below 30, it indicates that prices have dropped too far too fast and should soon start to rise. Since it’s between 70 & 30 it is interpreted as if the RSI is Above 50, it is a buy signal, and below 50 is a sell signal. As observed on the chart, it seems the values are above 50 so we can say that it is a buy signal. he RSI line is in a bearish zone i.e., the line trading above the median line. Since the 14 SMA line and RSI line are above the median zone, the market is bullish.

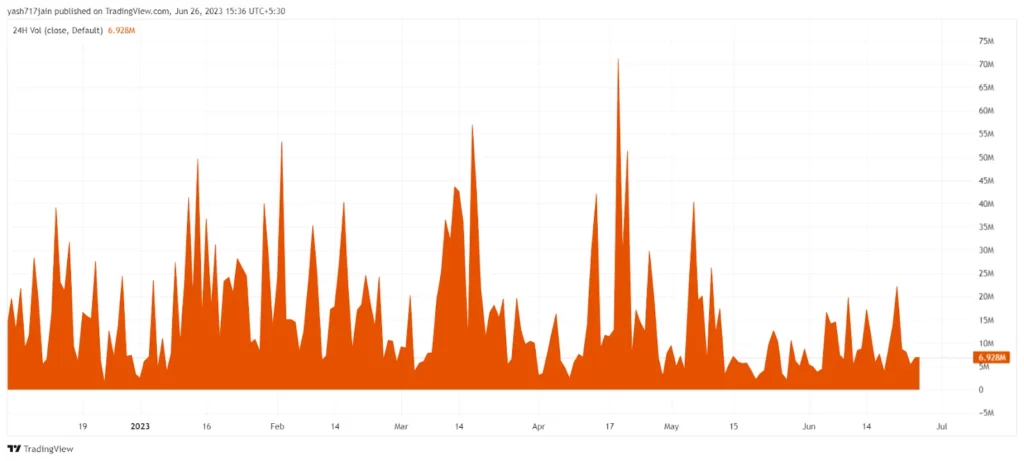

Volume Analyzation

The amount of Ethereum (ETH) traded in a day is $6,649,591,289. It rose by 5.86% since the last day. It seems that the trading activity is comparatively good in ETH in the short term and the presence of buyers for the coin increased significantly as well. The market is favorable and the presence of buyers for the coin increased significantly as well. Therefore, it can push the price up due to the considerable volume present in the market.

Conclusion

Currently, the technical parameters for the Ethereum (ETH) coin indicate bullish pressure in the long trend. The sentiments of investors and traders are bullish. If the price continues to move under the buyer’s control, it is expected to rise more shortly from the current levels. Presently, the sentiments of investors and & traders are bullish regarding the price of Ethereum in the 1D timeframe.

Technical Levels:

- The Nearest Support Zone is $0.258.

- The Nearest Resistance Zone is $0.322.

Disclaimer

In this article, the views and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.